Strong Informal Appeal Showing Help Fight Record Increases

O'Connor discusses how informal appeals helped fight increases in Galveston County.

GALVESTON, TX, UNITED STATES, July 28, 2025 /EINPresswire.com/ -- Galveston County is one of the top tourism spots on the Gulf Coast. From the beaches to the boardwalk, the hospitality industry is king for Galveston Island and the surrounding area. The area has begun welcoming more permanent residents and businesses in recent years and Galveston County is now one of the most populated counties in the Lone Star State. With much of Galveston County’s premier real estate in limited supply, the demand for all property types across the county has never been higher.The Galveston County Central Appraisal District (GCAD) has responded to this demand by inflating prices across the county. In 2025, GCAD estimated that residential property increased in value by 7.5%, while commercial property jumped by an incredible 18.1%. In response, the people of Galveston County began filing property tax appeals at a record rate. Galveston County is one of the most protested counties in Texas, with over 35% of all property being protested in 2023. Informal appeals are now done, and the long task of processing Appraisal Review Board (ARB) hearings is finally beginning. O’Connor will focus on how successful the round of appeals was and where it had the most impact.

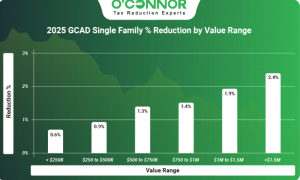

Galveston Homes Save Billions in Value

Between more homes being repurposed as AIRBNBs and a higher demand for land, Galveston County has seen a huge demand for homes. The 7.5% general growth translated into an increased total value of $3.39 billion. The largest slice of value was attributed to homes worth between $250,000 and $500,000, which were responsible for $22.47 billion of the $50.21 billion total. These homes were protested down 0.9% with informal appeals, cutting just over $200 million from the tax burden. Homes between $500,000 and $750,000 were in second place and managed to get a better return of 1.3%. The percentage returned trended upward, until homes worth over $1.5 million saw a return of 2.4% thanks to informal protests.

Just like when it comes to worth, most of the value in Galveston Counties is for average-sized residences. Homes under 2,000 square feet were responsible for $19.98 billion of the total value, while those between 2,000 and 3,999 square feet contributed $24.93 billion. These two property subtypes achieved cuts of 0.9% and 1.3% respectively, the largest cuts in total value. Homes between 4,000 and 5,999 square feet found a happy middle with a reduction of 1.7% against a total of $4.41 billion. Though they only accounted for $281.70 million of the total, homes over 8,000 square feet saved 3.9%.

Thanks to migration and a growing economy, Texas has had a building boom in the past few decades, with Galveston County certainly being a part of this trend. 43% of all housing value in the county was built between 2001 and 2020. This big block was able to save 1.1% thanks to informal appeals. 28% of home value was built between 1981 and 2000, which were able to knock 1% of their value off with appeals. New construction is already responsible for 5% of all value in Galveston County and was able to land a reduction of 1.8% opposed to a growth spike of 42.2%. Homes from between 1961 and 1980 still had some life in them and were responsible for 14% of all value while getting a reduction of 1.2%.

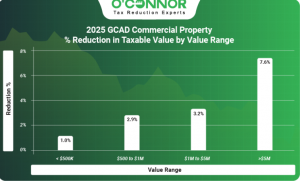

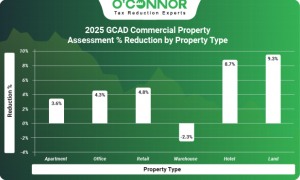

Record Commercial Increases Blunted with 6.3% Reduction

The main story for 2025 in Galveston County was the extensive spike in commercial property values. These values had been on a steady increase, but the jump of 18.1% caught many business owners off guard. Thanks to the large number of annual appeals, these were quickly protested. The first round of appeals managed to get an overall reduction of 6.3%. Most of this came from commercial properties worth over $5 million, which accounted for $9.96 billion of the $13.52 billion total. A reduction of 7.6% for these commercial properties opened the floodgates and was the main reason that the overall value was taken down a peg. Commercial properties worth between $1 million and $5 million were in second place in total value and managed to save 3.2%. Even commercial properties worth less than $500,000 managed a reduction of 1%

When most Texans think of Galveston County, they think of hotels. These received an enormous spike of 20.1% in 2025. With a concerted protest effort carried out, hotels were able to see a reduction of 8.7%. Apartments are the largest block of commercial property in Galveston County, as they are in most of Texas. Apartments originally totaled $3.88 billion, but were eventually knocked down 3.6% by informal appeals. Land was the biggest controversy of the 2025 increases but ended up getting the biggest reduction with 9.3%. Only warehouses made it through the initial process with no reduction.

While home values are closely linked to recent construction, a lot of commercial value is more spread out. 2001 to 2020 was still the largest timeframe, but only represented 23% of the total value, and this was before being reduced by 2%. 14% of commercial value was built between 1981 and 2000, while 15% was from 1961 and 1980. These two categories saved 5.7% and 5% respectively. New construction was responsible for 8% of all value and had seen an increase of 44.9% in the initial evaluation. This was trimmed by 5.4%.

Apartments Secure Overall Reduction of 3.6%

Galveston County is much more than the island itself, and apartments are still the king of commercial property across the county. When looked at through the lens of age of construction, we see that apartment value is something of a dichotomy. 30% of apartment value was built between 2001 and 2020, while 17% is thanks to new construction. These categories received cuts of 0.4% and 7.3% respectively. On the other hand, 30% of value was built between 1961 and 1980, while 19% was built between 1981 and 2000. These older buildings were able to achieve reductions of 5% and 1.7%.

GCAD breaks down apartments into three basic categories. Generic apartments were the largest block by far and totaled $3.49 billion before getting a solid reduction of 3.8%. 4–20unit apartments were a distant No. 2 and received no reductions. Garden apartments were a small part of the total value but still managed to get a reduction of 1.6%.

Office Space Saves 4.3%

GCAD estimated that offices increased in taxable value by 20.2% in 2025, bringing their total value to $1.46 billion. As appeals started rolling in, this figure was quickly reduced by 4.3% to $1.38 billion. Like most properties when assessed by age of construction, offices built between 2001 and 2020 made up the biggest slice of total value with 39%. This key block experienced an initial reduction of 1.4%. A significant cut came from offices built between 1981 and 2000, which were reduced by 6.1%. These were the second-most valuable offices in Galveston County, according to GCAD. The biggest reduction was 7.6% for offices built between 1961 and 1980, which were the No.3 office category when it comes to pure value. New construction got a tiny reduction of 0.3%.

GCAD only breaks offices down into two categories. Generic office buildings totaled $1.05 billion in value before being reduced by 5.8% to $985.31 million. Medical offices were initially valued at $399.58 million but were quickly cut down by 0.3% to $398.12 million.

Retail Saves 4.8%

Retail is the third-largest commercial property type in Galveston County, only behind apartments and raw land. Retail was assessed by GCAD to be worth $1.68 billion in value in 2025. After appeals reduced this by 4.8%, the total was $1.60 billion. 49% of the total value was built between 2001 and 2020, which received a reduction of 2.4%. No. 2 in value were retail properties built between 1961 and 1980 secured a reduction of 3.5%. In third place, retail buildings constructed between 1981 and 2000 saw an enormous reduction of 13.3%. New construction is not much of a factor in value or reductions but still earned a meager reduction of 0.2%.

Retail property is typically broken down into many subtypes, but GCAD only used an unhelpful two. Single-occupancy retail was by far the biggest with a total of $1.68 billion, which was reduced by 2.6% to $1.60 billion. Malls only accounted for $50.01 million but achieved a whopping reduction of 73.9%.

Warehouses Struggle

Warehouses in Galveston County were the smallest commercial property, an oddity for Texas. Totaling only $259.50 million, warehouses actually experienced an increase of 2.3% in the appeals process. 48% of all warehouse value was built between 2001 and 2020, which gained 5.6%, skewing the total value savings to an increase. All other age groups managed reductions, with those constructed between 1961 and 1980 leading the way with 1.1%. New construction was a non-factor for both value and reductions.

GCAD divides warehouses into three groups. The largest, industrial warehouses, saw a gain of 3.2%. Mini warehouses managed a savings of 0.6%, while generic warehouses had neither a reduction nor an increase.

Informal Appeals are Just the Beginning

Galveston County appeals can certainly be seen as a mixed bag so far. There has been some strong momentum built, but there is a large series of increases that need to be brought down, especially for commercial property owners. It should be noted that this is only the first step in a long journey. Informal appeals are important, especially for smaller homes and businesses. But they do set the stage for appeals to the appraisal review board (ARB). These formal hearings are often counted on by high-dollar property owners to settle things that informal agreements cannot. The ARB is quickly becoming more important to the average homeowner; however, especially in places like Travis or Denton Counties.

Galveston County is one of the most protested counties in Texas. This is thanks to prime real estate for living and business being at a premium on Galveston Island. The competitive spirit of the average Galveston County property owner has been making ARB hearings a bigger part of the process every year. In 2023, $1.73 billion in value was cut by informal appeals, while $2.64 billion in value was reduced with ARB hearings. As the value of homes and commercial properties increases, so will the need for ARB hearings.

O’Connor is here to help. For over 50 years, we have taken on appraisal districts across the country. Based in Houston, we know GCAD and the local ARB very well. We can give you the right evidence and representation needed to win your case. Even if you did not protest this year, we can get things ready for next year. Values are only going up and this is a marathon, not a sprint. We will protest your taxes annually automatically, finding savings in years where we can help and ensuring that you are paying your fair share every year. There is no cost to join, and you will only be charged if we lower your taxes.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.