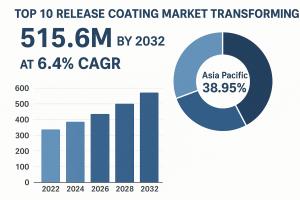

Top 10 Release Coating Companies Driving USD 515.6 Million Market by 2032 at 6.4% CAGR

Asia Pacific Powers Global Release Coating Market Toward USD 515.6 Mn by 2032 | Inside the Release Coating Boom: How the Top 10 Players Are Driving 6.4% CAGR

NY, UNITED STATES, October 16, 2025 /EINPresswire.com/ -- The global release coating market was valued at USD 295.0 million in 2023 and is expected to increase from USD 311.0 million in 2024 to USD 515.6 million by 2032, growing at a CAGR of 6.4% over the forecast period. In 2023, Asia Pacific led the market with a 38.95% share. The U.S. market is also set to expand substantially, reaching an estimated USD 78.1 million by 2032, driven by growing demand for labels used across packaging and consumer goods industries as a key physical product identifier.Release coatings market enable easy removal of adhesive materials without leaving residue or damaging the substrate. The rise of pressure-sensitive products such as labels and tapes has intensified demand for high-performance release coatings. Manufacturers are also focusing on sustainability, developing formulations that reduce environmental impact while maintaining superior performance.

Request a Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/release-coating-market-107632

Top 10 Release Coating Companies

1. Dow Inc. (USA)

Dow is a global leader in silicone-based release coatings, offering a wide range of products that cater to various industries, including packaging, automotive, and electronics. Their Silastic™ and Syl-Off™ product lines are renowned for their superior release properties and environmental compliance.

S2. hin-Etsu Chemical Co., Ltd. (Japan)

Established in 1926, Shin-Etsu Chemical is one of Japan's largest silicone manufacturers. Their release coatings are widely used in applications requiring high transparency and water resistance. The company continues to innovate, introducing advanced products to meet evolving market needs.

3. Momentive Performance Materials Inc. (USA)

Momentive is a prominent player in the silicone industry, providing high-performance release coatings under brands like SilForce™ and Tospearl™. Their products are known for excellent release performance and are utilized in various applications, including medical devices and consumer goods.

4. Wacker Chemie AG (Germany)

Wacker Chemie is a leading chemical company that manufactures silicone-based release coatings. Their products are designed for applications requiring high heat resistance and durability. Wacker's commitment to sustainability is evident in their development of eco-friendly formulations.

5. Evonik Industries AG (Germany)

Evonik specializes in siloxane-modified release coatings that offer excellent release properties and are suitable for high-speed processing. Their coatings are widely used in the label and tape industries, contributing to enhanced production efficiency.

6. Elkem ASA (Norway)

Elkem provides a range of silicone-based release coatings that are known for their excellent release performance and environmental compliance. Their products are used in various applications, including automotive and consumer goods packaging.

7. Henkel AG & Co. KGaA (Germany)

Henkel offers a variety of release coatings, including both silicone and acrylic-based products. Their solutions are designed to meet the diverse needs of the packaging industry, providing reliable and efficient release performance.

8. HITAC Adhesives & Coatings (USA)

HITAC specializes in custom release coatings for various applications, including medical, consumer, and industrial sectors. Their products are known for their high-quality performance and are tailored to meet specific customer requirements.

9. Mayzo, Inc. (USA)

Mayzo develops release coatings that enhance the performance of pressure-sensitive adhesives. Their products are widely used in packaging and hygiene products, ensuring optimal adhesion and easy release.

10. Coating Place, Inc. (USA)

Coating Place offers custom coating solutions, including release coatings for various industries. Their products are known for their high-quality performance and are tailored to meet specific customer requirements.

Market Trends Driving Growth

1. Rising Demand in Label Applications:

The surge in label usage in consumer goods and packaging industries has significantly fueled the release coating market. Labels serve as a medium for brand promotion, product specifications, safety information, and pricing. Digital printing technologies, variable barcodes, and enhanced traceability have further increased the reliance on high-quality release coatings.

2. Healthcare Industry Expansion:

Growth in the medical sector, driven by rising disposable income, aging populations, and increasing urbanization, has boosted demand for release coatings. Medical devices and disposable products require precise labeling and coding, which is made possible by solventless and silicone-based coatings.

3. Polydimethylsiloxane (PDMS) Coatings:

PDMS-based coatings have emerged as a key trend due to their excellent release performance, quick curing, and cost-effectiveness. Manufacturers are also combining PDMS with materials such as carbamates, fluorocarbons, polyolefins, and polyacrylates to create coatings suitable for a variety of substrates and applications.

4. Sustainable and Clean Label Initiatives:

Environmentally conscious consumers and industries are pushing for clean and transparent product labeling. This is driving the development of eco-friendly coatings with reduced chemical additives while maintaining high functionality.

Speak to Analyst : https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/release-coating-market-107632

Frequently Asked Questions (FAQs)

1. What is the global release coating market size?

The market was valued at USD 295.0 million in 2023 and is projected to reach USD 515.6 million by 2032, growing at a CAGR of 6.4%.

2. Which region leads the release coating market?

Asia Pacific led the market with a 38.95% share in 2023, driven by high packaging demand and expanding industrial sectors.

3. What are the key applications of release coatings?

Release coatings are used in labels, tapes, hygiene products, medical devices, food packaging, bakery items, graphic films, and various industrial applications.

4. What materials are commonly used in release coatings?

Silicone and non-silicone materials are widely used, with PDMS-based silicones gaining popularity for superior release performance.

5. How are trends like clean labels affecting the industry?

Clean labels are pushing manufacturers to develop eco-friendly coatings with minimal chemical additives, ensuring sustainability and regulatory compliance.

6. Which companies dominate the release coating market?

Top players include Dow Inc., Wacker Chemie AG, Evonik Industries, Shin-Etsu Chemical, Momentive, Elkem ASA, Coating Place, Mayzo, HITAC, and SOLV Inc.

Related News

Geosynthetics Market : https://www.fortunebusinessinsights.com/geosynthetics-market-102545

Industrial Fasteners Market : https://www.fortunebusinessinsights.com/industrial-fasteners-market-102732

Protective Clothing Market : https://www.fortunebusinessinsights.com/protective-clothing-market-102707

Flat Glass Coatings Market : https://www.fortunebusinessinsights.com/flat-glass-coatings-market-102910

Hempcrete Market : https://www.fortunebusinessinsights.com/hempcrete-market-110107

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.